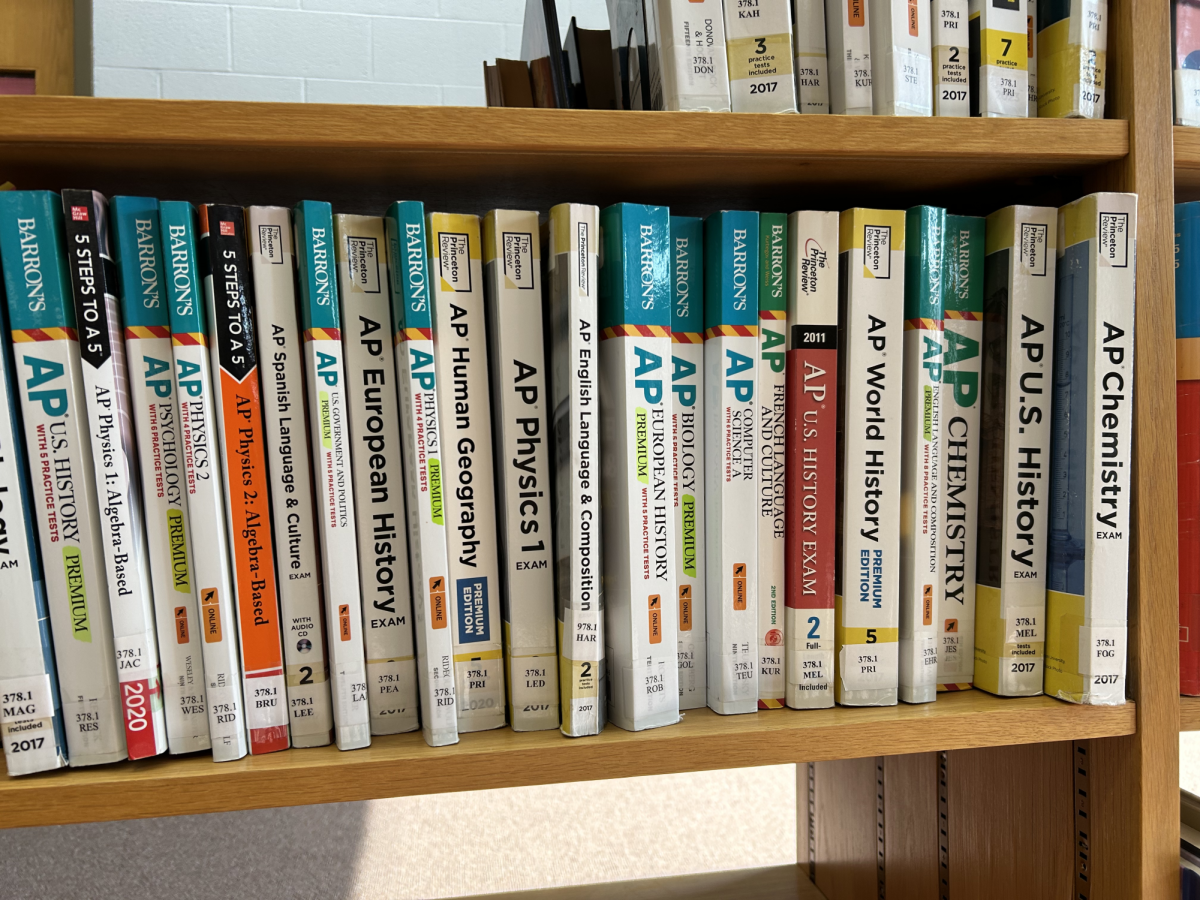

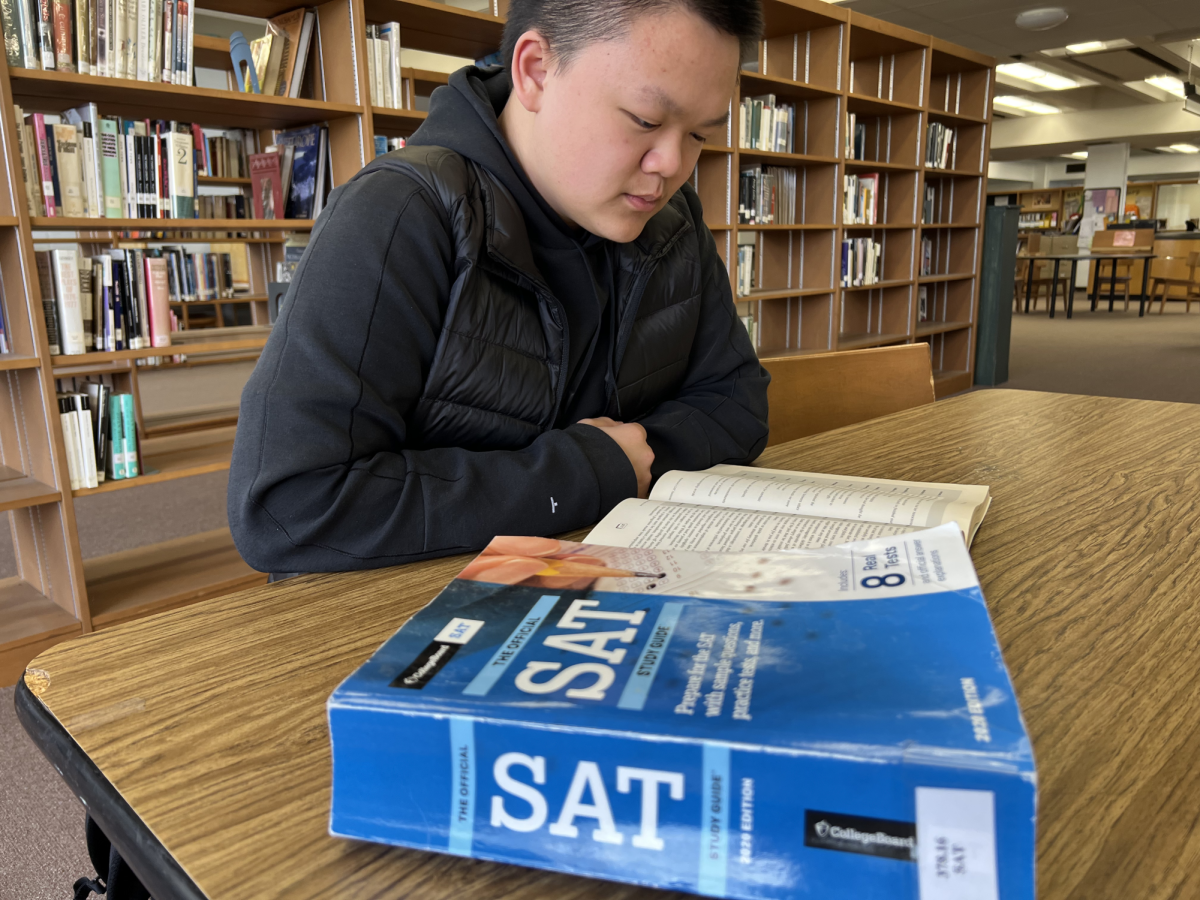

Every year, college tuition increases, discouraging high school students from attending. The trades are becoming more and more popular, as well as the military because kids do not have to worry about finances or debt that they could not imagine having to pay back.

“Enrollment has dropped an enormous amount since the pandemic. There are 1.2 million less students in college than there were in 2019, but even before then, it was falling at a gradual rate”. According to the Today, Explained podcast.

After everything with covid, the motivation to attend school and pursue a degree has significantly dropped. Each day, more students are choosing online schools or courses that they can complete from the comfort of their own home.

“Community college enrollment is particularly down, as is unfortunately Black and African-American enrollment, especially among Black and African-American men” (Today, Explained).

Community college is essentially a cheaper alternative, but they are also experiencing a decline in their enrollment. Not only are students choosing against it, but Black and African-American students are in the mix as well, making these schools less diverse. But, it must be for a certain reason, right?

“And then there’s the end of the month when the bill comes in, when I start to regret going to such an expensive institution” (Today, Explained).

The hot topic here is student debt. On average, Americans pay up to $503 each month to help pay back their student loan debt. That is $6,036 each year! Of course, those numbers are just the average at the moment, some people could be paying even more depending on what type of plan they have set up.

“American sentiment toward college, toward higher ed, is at an all-time low” (Today, Explained).

Having to pay back an absurd amount of money is a huge contender as to why people simply are not attending. Finding work in other areas seems like a much easier and more realistic option for many. With that being said, people are still having a hard time finding jobs because many positions require a certain level of education that just is not applicable to many.

“More than half (58%) of young adults in the U.S. are living with their parents”, According to prudential.com.

With incredibly high living prices, people cannot afford to move out of their parents’ homes to live alone, and financially support themselves. Since these kids are not living at college campuses or in other states, it is easier for them to start working while they live at home so that they can save up money and eventually move out. All in all, college debt is setting people up for a lifetime of debt that they have to pay back with high interest rates instead of just finding alternative routes in life.